Batch 8

Executive Programme in Data Science and AI for Managers

- IIML Executive Alumni Status

- Three-day Immersion at IIML Campus

- Live Sessions by Industry Experts

- 100% Live-online sessions by IIM Lucknow Faculty

Programme Overview

In a world where information reigns supreme, harnessing the potential of data analysis is no longer a mere advantage – it's a necessity. The modern business ecosystem thrives on insights and the program will help you delve into the managerial intricacies of data science, machine learning, AI algorithms, and business intelligence to spearhead data-enabled business process transformation, leverage data within projects & workflow, and navigate data-driven challenges. IIM Lucknow's cutting-edge program is designed to empower decision-makers with a managerial understanding of Data Science, Big Data Analytics, Cognitive Analytics, and Cloud Deployment. Master Descriptive, Inferential, and Predictive Analytics to analyze and anticipate business outcomes. Develop expertise in Machine Learning algorithms, AI, and Deep Learning applications for decision-making. And explore real-world use cases, and learn to deploy data-driven solutions.

Advance your data science and AI capabilities, navigate complexities, drive innovation, and propel organizational growth with confidence.

Programme Highlights

Receive a certificate of completion from one of India’stop B-Schools (NIRF, 2023)

Experience a three-day on-campus immersion at the IIM Lucknow campus

Receive hands-on exposure and learning to make effective data-driven business decisions

Become industry-ready with real-world case studies, a project and tools using Excel and R

Gain a global outlook with insights from IIM Lucknow faculty and industry experts

Expand your professional network and interact with experienced peers

Note: The primary mode of learning for this programme is via live online sessions with faculty members. Post-session video recordings from live sessions will be available to the participants for two weeks (approx. 14 days) after the live session is conducted, only at the discretion of the Programme Directors/ Faculty. All faculty may not permit it. Emeritus or the institute does not guarantee availability of any session recordings after the two-week period is over.

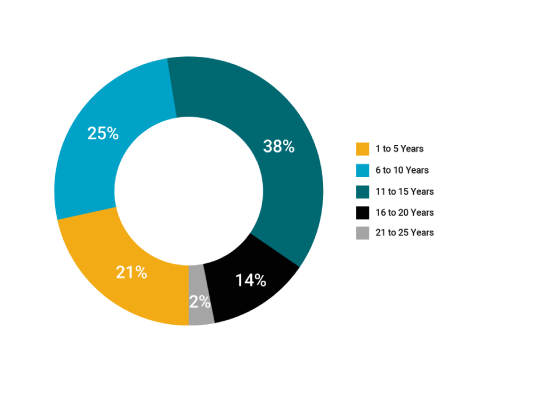

Who is this Programme for?

Experienced professionals keen to implement data science methodologies and build a data- first culture to drive insight-driven transformation effectively and lead disruptive analytical innovations.

The programme is suitable for mid-to-senior career professionals in job roles that demand data interpretation and data science skill sets across various facets of business and require them to become more efficient in driving data and AI-led projects.

Participant Testimonials

Tools Included

Note:

All product and company names mentioned in this material are trademarks or registered trademarks of their respective holders. Their use does not imply any affiliation with or endorsement by them

The tools will be taught by teaching faculty, industry practitioners, or linked to relevant knowledge bases for your reference and self-guided learning

Programme Modules

Note:

The in-campus modules are subject to the conditions/ unavoidable circumstances that prevail at the given point in time.

Modules/ topics are indicative only, and the suggested time and sequence may be dropped/ modified/ adapted to fit the participant profile & programme hours.

The session recordings may be made available on the LMS portal in a non-downloadable format for a limited period subject to the condition of faculty discretion regarding the allowance of recordings of their classes.

The programme curriculum includes individual assignments, simulations, group projects & presentations to apply and demonstrate classroom learnings.

Program Certificate

On successful completion of the programme, with a minimum 75% attendance and satisfactory academic performance, participants will be awarded a certificate of completion and will be eligible for the IIM Lucknow Executive Alumni Status.

Note:

The certificate shown above is for illustrative purposes only and may not be an exact prototype of the actual certificate. IIM Lucknow reserves the right to change the certificate and specifications without notice.

The session recordings may be made available on the LMS portal in a non-downloadable format for a limited period subject to the condition of faculty discretion regarding the allowance of recordings of their classes.

Key Programme Takeaways

Advance your data science and AI capabilities to identify strategic growth opportunities

Develop structured managerial understanding of Big Data Analytics, Cognitive Analytics, and Cloud Deployment.

Gain managerial understanding of AI algorithms to enable business transformation

Execute high-performing data science and AI projects through a data-driven systematic approach

Learn the science of extracting structured data-backed insights for informed decision-making

Programme Directors

Associate Professor, Finance & Accounting, Indian Institute of Management Lucknow

Prof. Alok Dixit teaches Management Accounting, Financial Derivatives, and Applied Financial Time Series Econometrics at IIM Lucknow. He has a PhD in Finance from IIT Delhi. H...

Associate Professor, Decision Sciences

Prof Gaurav Garg teaches quantitative analysis for management, business statistics, and advanced data analysis. He has a PhD, M.Phil, and M.Sc in Statistics. His research area...

IIM Lucknow Executive Education Alumni Status

Upon completion of the programme, participants will need to register with a one-time registration fee of INR 10,000 + GST to receive the prestigious IIM Lucknow Executive Alumni Status. The benefits include:

Executive Alumni status of the Indian Institute of Management Lucknow

Receipt of all programme brochures and newsletters from IIM Lucknow (MDP Office)

Details of Souvenirs available with MDP office

Lifelong access to a network of distinguished IIM Lucknow Executive Alumni

Access to the IIM Lucknow Campus Library (onsite access)

10% discount in fee for any additional program (Open program, Online) at IIM Lucknow (Lucknow and Noida campus)

10% group discount on the fee for referring participants (minimum group of five)

Emeritus Career Services

15 Recorded sessions and resources in the following categories (Please note: These sessions are not live):

Resume and Cover Letter

Navigating Job Search

Interview Preparation

LinkedIn Profile Optimisation

Job Placement Assistance

Job openings are sourced by the CS Team and virtual hiring drives are conducted for the applicants.

Dedicated online portal for all candidates where they can apply for jobs & track past applications.

Regular job postings.

Note:

IIM Lucknow or Emeritus do NOT promise or guarantee a job or progression in your current job. Career Services is only offered as a service that empowers you to manage your career proactively. Emeritus offers the Career Services mentioned here. IIM Lucknow is NOT involved in any way and makes no commitments regarding the Career Services mentioned here.

Job placement assistance is focused for students with 0 to 5 yrs of experience.

This service is available only for Indian residents enrolled in select Emeritus programmes.

Pay Later - Finance Options

Programme Fee | Maximum Loan Amount Available | Tenure (months) | EMI |

|---|---|---|---|

INR 2,35,000 + GST | INR 2,63,435 | 36 | INR 9,740 |

Note:

The above EMI's are indicative. The EMI's offered by each of the loan providers might vary from the above figures, depending upon tenure and loan amount to be disbursed.

Other EMI tenures available (Months):

Propelld: 6/12/18/24/30/36/42/48

Early registrations are encouraged. Seats fill up quickly!

Flexible payment options available.

Starts On